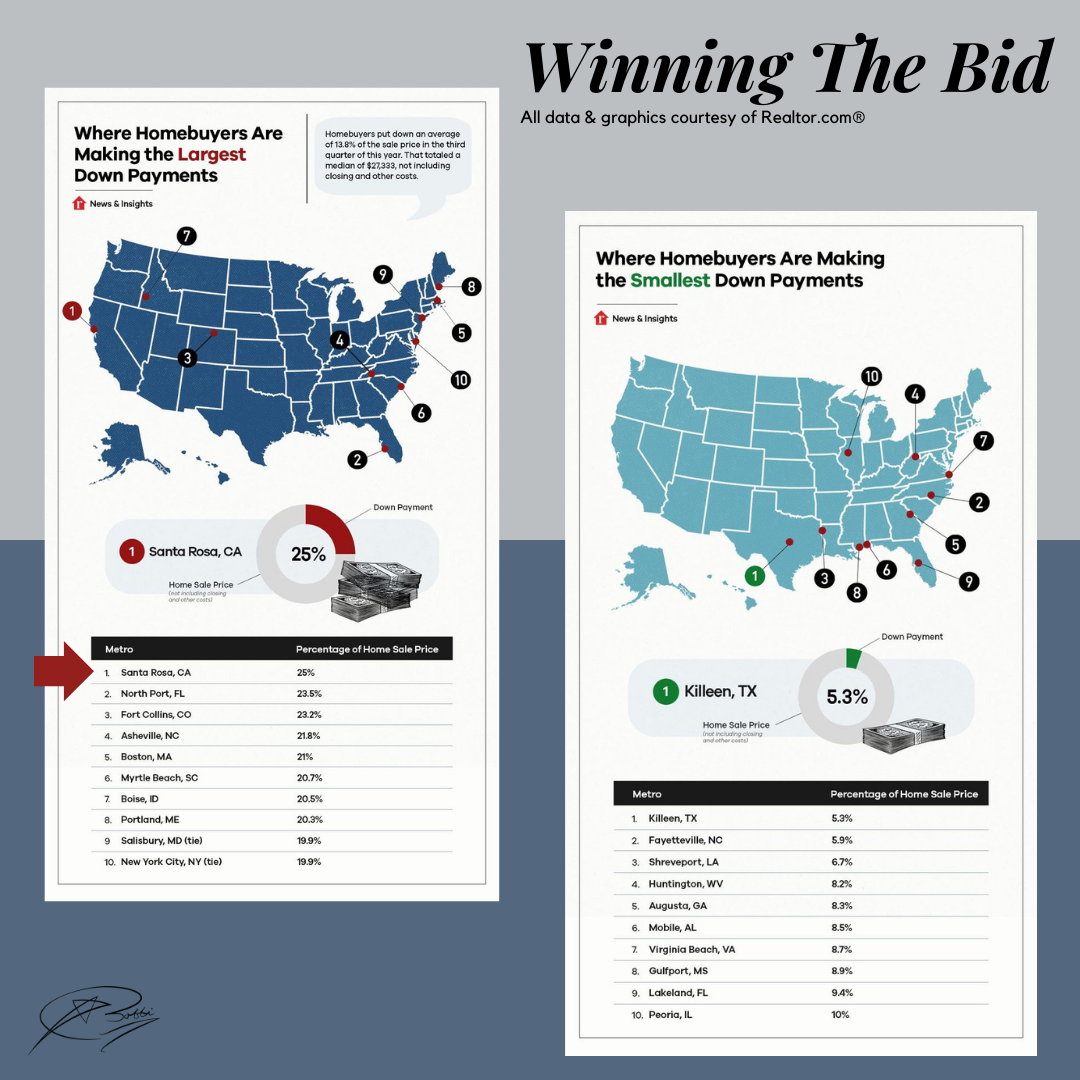

Monday Market Update: Biggest & Smallest Down Payments In The US

One of the cities with the biggest down payments is… in Sonoma County!

There are two words that strike fear in many first-time home buyers: Down. Payment. But like most real estate strategies, the size of the down payment you need depends very much on your local micro markets. Realtor.com® has just released two lists which we just had to share – the top 10 cities in the US with the highest and lowest down payments.

Note that the list only includes one city per state to ensure geographic diversity. The other positive news for buyers is that down payment sizes have fallen overall as housing has become less competitive in some areas. (This does not apply to ALL markets in any way – especially Silicon Valley, so we hate to say it – but don’t get too excited!)

*Note the red arrow is pointing to a city not far from here... ;).

The key take-away for us is that there is no one down payment size that is ‘right’ for every buyer in any one location. Your down payment can be influenced by any number of factors including but not limited to: your own financial circumstances, if you are moving up or buying for the first time, how competitive your local market is, if your county or state has any down payment assistance programs available, how much you want to put down vs. keep in savings… and so much more!

As you review the differences above, we hope that you get some perspective on just how different real estate looks and feels from state to state and city to city. We also hope that you not only get inspired but feel empowered to move forward with a down payment that you are comfortable with. If you are ever working on a loan scenario that just doesn’t feel ‘right’, trust your gut, get a second opinion and talk to multiple, trusted members of your network. It doesn’t matter what works on paper if it does not truly ‘work’ for you!

Resource Used: Winning the Bid: The Cities Where Homebuyers Are Making the Largest—and Smallest—Down Payments

Best wishes,

Bobbi & Team

Bobbi Decker

DRE#00607999

Broker Associate, Bobbi Decker & Associates

650.346.5352 cell

650.577.3127 efax

www.bobbidecker.com

NAR Instructor….“Designations Create Distinctions”

CIPS, SRS, ABR, CRS, SRES, GRI, CLHMS, REI, AHWD, RSPS, MSLG

Bobbi Decker & Associates fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. For more information, please visit: http://portal.hud.gov/