Monday Market Update: A National Overview [Infographic]

A notable change in this month’s data is the rise of inventory!

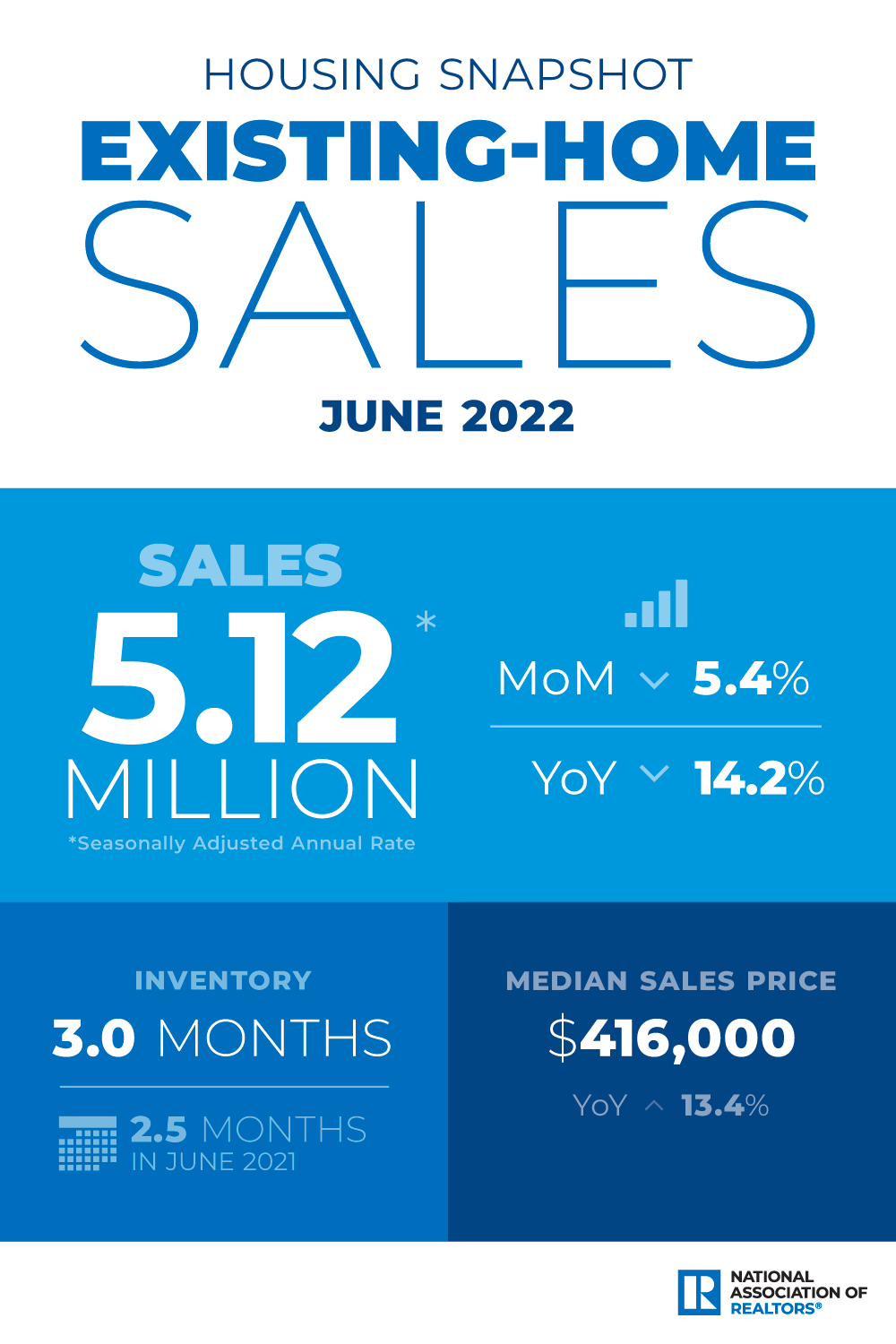

The real estate market continues to demonstrate shifts towards balance and one of those moves is happening with inventory! The latest infographic from NAR® below outlines that on a big picture, national level – sales are down, home prices are still up and inventory is rising (all in year-over-year comparisons to June 2021).

While the decline in sales represents a pattern of 5 months of decline, the last two months of sales brought levels to pre-pandemic levels, still well in range of the rate of sales from 2015-2019. Thus, we are by no means at ‘rock bottom’ levels of homes moving on the market, we are just witnessing a slower pace.

Inventory still remains at historic lows, but the jump from 2.5 months supply to 3 months supply of homes on the market is the first time since mid-2019 that we have seen any year-over-year inventory gains. Mortgage News Daily (MND) reports that “Inventory is typically increasing at this time of year, but the next chart shows that it's increasing at a far faster pace than it has over the past 2 years. It's also been accelerating whereas year-over-year inventory gains were cooling off in 2019.”

Price gains of 13.4% year-over-year are still considered a ‘scorching’ pace according to MND, but still less than the 19-20% price increases that defined the last two years.

The interesting data point that emerged in June 2022 was that days on market actually dropped from 16 to 14, something you don’t typically see when inventory is increasing. NAR Chief Economist Lawrence Yun explains that “Homes priced right are selling very quickly, but homes priced too high are deterring prospective buyers."

The bottom line is that there is still opportunity to buy and sell, however, the results are going to be critically dependent on very current, hyperlocal data as well as a solid strategy and realistic expectations. This isn’t to say that you should settle in any situation, but you should consider if your goals can be met by adjusting your reach. The answer may surprise you in a good way! 😉

Have a great week,

Bobbi Decker

DRE#00607999

Broker Associate, Bobbi Decker & Associates

650.346.5352 cell

650.577.3127 efax

www.bobbidecker.com

NAR Instructor….“Designations Create Distinctions”

CIPS, SRS, ABR, CRS, SRES, GRI, CLHMS, REI, AHWD, RSPS, MSLG

Bobbi Decker & Associates fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. For more information, please visit: http://portal.hud.gov/